Table Of Content

- Best and cheapest home insurance in Texas for 2024

- Coverage options in Texas

- Silvercorp to Acquire Adventus, Creating a Geographically Diversified Mining Company

- Texas has some of the highest homeowners insurance rates in the country; here's why

- The Best Homeowners Companies in Texas for Expensive Homes

- How to save on home insurance policy renewals in Texas

- What’s Not Covered by Texas Homeowners Insurance?

The average cost of home insurance in Texas is $4,400 per year, or about $367 per month, according to a NerdWallet rate analysis. Now is the time to get on the phone with your insurance advisor or company to comb through the fine print and make sure the coverage you think you have is what you're paying for. "It's just frustrating. You'd think the insurance companies are there to help you out when you're in need, but then they cancel and don't want to pay out," Hooge said. Texas nears the top of the list of states with the fastest-rising home insurance rates.

Best and cheapest home insurance in Texas for 2024

Progressive's HomeQuote Explorer® lets you instantly compare homeowners insurance rates and coverages from multiple companies. The average cost of homeowners insurance in Texas is $3,257 per year according to NerdWallet.2 That's 100% higher than the national average. However, this rate may be higher or lower for you depending on the value and age of your home, the coverage you select, your claims history, and a wide variety of other factors.

Coverage options in Texas

There are approximately 700,000 homes in Texas at extreme risk of flooding, so you'll want to consider getting flood insurance if you purchase a house in the area. The average cost of flood insurance in Texas through the National Flood Insurance Program is $676 per year, making the Lone Star State one of the cheapest in the country for flood insurance. The table below highlights the average annual premium in Texas for five different levels of dwelling coverage, which is the part of your policy that covers structural damage to your home. While some of its competitors may not have the financial strength to pay out claims after several natural disasters in the same year, State Farm isn't one of them. Best for financial strength and stability — only six insurance companies out of nearly 70 we reviewed hold this title. Progressive offers the most affordable homeowners insurance in Texas, at an average annual premium of $2,962 a year, followed by USAA and State Farm.

Silvercorp to Acquire Adventus, Creating a Geographically Diversified Mining Company

Homeowner's insurance rates in Houston are rising, and climate change may be partly to blame - KTRK-TV

Homeowner's insurance rates in Houston are rising, and climate change may be partly to blame.

Posted: Wed, 14 Feb 2024 08:00:00 GMT [source]

A licensed insurance professional can review your policy and help identify areas where you may need to purchase separate coverage or adjust your current coverage. Owned by Allstate, Esurance combines innovative technology with solid insurance coverage. If you're someone who leans toward digital platforms and prefers managing your policy online, Esurance could be a fitting choice. Its digital tools are designed to make policy management convenient and straightforward. For homeowners who would appreciate a seamless digital experience without the need to compromise on coverage, Esurance could be an option to consider.

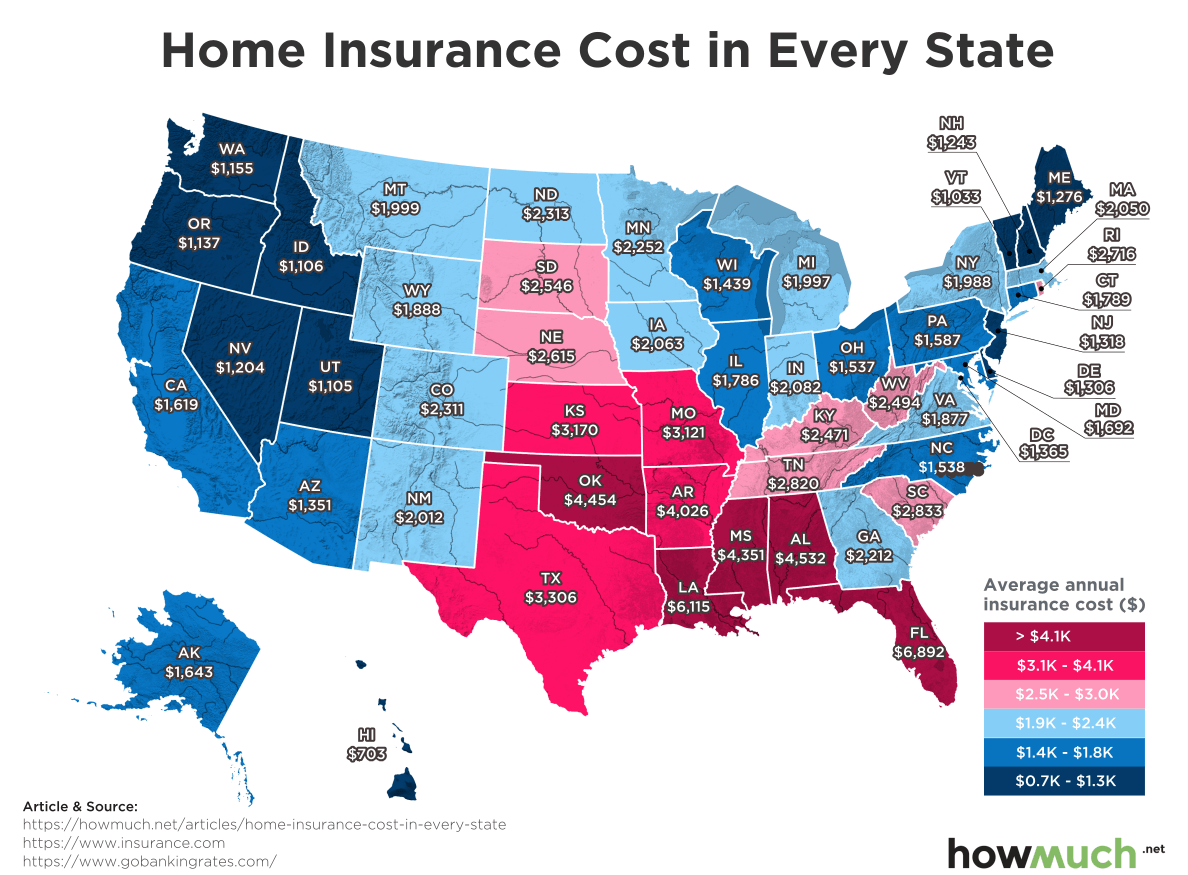

Texas has some of the highest homeowners insurance rates in the country; here's why

Our content is based solely on objective research and data gathering. We maintain strict editorial independence to ensure unbiased coverage of the insurance industry. Your home insurance policy won’t cover every problem that happens to your home. Getting a reasonable rate on home insurance is a top concern for most homeowners. Your best bet to finding an affordable price is by comparison shopping. We analyzed average costs for large insurers to help you locate the best homeowners insurance in Texas.

The Best Homeowners Companies in Texas for Expensive Homes

Hooge said he's now scrambling to be covered before it's too late. We’re already dealing with high prices, high mortgage rates, and high property taxes. According to the Insurance Information Institute, there were 1,123 hail events recorded in 2023 — more than in any other state. Kara McGinley is deputy editor of insurance at USA TODAY Blueprint and a licensed home insurance expert. Previously, she was a senior editor at Policygenius, where she specialized in homeowners and renters insurance.

How to save on home insurance policy renewals in Texas

How much you pay for home insurance depends on where in the state you live. For example, the average cost of homeowners insurance in Houston is $6,610 per year, while homeowners in Dallas pay $5,045 per year, on average. Meanwhile, home insurance is much cheaper in El Paso at just $2,405 per year, on average. The Nationwide website offers plenty of ways to manage your policy, including filing and tracking claims, paying bills and getting quotes. Get a homeowners insurance quote for your Texas home to see your potential savings.

The cheapest home insurance company in Texas is Progressive for most coverage levels, although USAA is the cheapest at a dwelling coverage of $200,000. USAA also ranked at the top of our list of best companies, though it's only open to military families. A standard home insurance policy won’t cover you for flood damage. Considering Texas has hundreds of floods each year, it’s a good idea to have flood insurance. In this state, natural disasters, like named tropical cyclones and hailstorms, may have a separate deductible from your policy deductible.

Since there’s a higher change of homeowners filing a claim, insurance companies charge higher rates to account for the added risk. Generally, individuals with better credit scores enjoy lower home insurance premiums. In a state like Texas, premiums are higher in large part due to the outsized risk of natural disasters in certain areas. As hurricanes, tornadoes, and hail continue to worsen and cause extensive damage to homes all over the state, insurance companies account for this by charging higher rates. Over 100 tornadoes swept through several states at the end of April, 2024, including parts of Texas, Kansas, Nebraska, Missouri, and Iowa. Homeowners impacted by these tornadoes may need to file a claim with their insurance company for damage caused by the storms.

USAA, State Farm, and Mercury are also among the most affordable home insurance carrier options for Texas residents in 2023, as detailed in the table below. Progressive offers robust home insurance coverage and ways to save. Its bundling discount, which lets you save up to 20% on premiums and only requires you to pay one deductible if your home and car are damaged in the same event. Using a mix of internal and external rate data, we grade the cost of each insurance company's premiums on a scale from least expensive ($) to most expensive ($$$$$). AM Best is a global credit rating agency that scores the financial strength of insurance companies on a scale from A++ (Superior) to D (Poor).

As you look for the right company to work with, here are a few tips to make the process easier. Each type of coverage has a set dollar limit which represents the maximum amount that the insurance company will pay out. It’s important to read your policy carefully to know how much coverage you have. The average cost of homeowners insurance in Texas is $2,959 per year, which is higher than the national average. Bundling your home and auto policies with Nationwide can save you up to 20 percent on your coverage.

Experts told me that the skyrocketing rates are caused by a combination of high inflation, especially in the prices of building supplies, and Texas’s recent series of natural disasters. Between 2019 and 2023 Texas suffered an average of eleven billion-dollar events each year, with sixteen in 2023 alone. Whether you’re buying a new home or want to protect the property you currently own, it’s important to have sufficient homeowners insurance coverage in place. But home insurance policies can get expensive, depending on the coverage level you choose and your insurer.

Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Pat Howard is a managing editor and licensed home insurance expert at Policygenius, where he specializes in homeowners insurance.

Texas homeownership is trending at an all-time high, which means more people than ever before have assets to protect in the Lone Star State. Learn how easily Texans can obtain a homeowners insurance policy with customized coverage limits to stay protected against Mother Nature's most common perils. Tornadoes regularly hit Texas thanks to its location in Tornado Alley.

If you live on the Gulf Coast, for instance, then it may be in your best interests to purchase wind insurance to supplement the gap in your standard home insurance policy. Just keep in mind this doesn’t include coverage for flooding or storm surge damage — you’ll need home insurance, windstorm insurance and flood insurance to be properly covered in the event of a hurricane. MoneyGeek analyzed homeowners insurance quotes from the top insurance companies in Texas that were provided in partnership with Quadrant.

In comparison, the national average premium for home insurance is $2,604 annually. In addition to these standard coverages, some homeowners choose add-ons, either as endorsements to standard policies or as separate policies, to increase coverage. Some of these may be included in your Texas home insurance policy, but you should never assume; talk to your insurance company to make sure you have what you need. The cheapest home insurance company in Texas for $300,000 in dwelling coverage is Farmers, with an average rate of $484 per year, according to our analysis of 2022 rate data. To come up with our top picks, we looked at the 15 Texas companies with the highest market share in the state and chose the five with the highest overall Policygenius rating. Our ratings are based on each company's financial strength and customer satisfaction ratings, the number and quality of available coverages, and average policy premiums in 1,930 Texas ZIP codes.

No comments:

Post a Comment